Here are the US close regulars and other article links. Some interesting rumors floating around, some of them outlined below. It might be that they are just increasing the pressure on Greeks to vote "correctly" - or are actually preparing to kick Greece out.Of course, in order to make it look like they mean it, it will have to look like they mean it. This makes it very hard to decipher what is really going on.

My guess is they probably want to throw Greece out, as politically they could put all the blame on Greeks and the European banks are relatively safe, as their losses have already been socialized. But they have to make it look like they really, really wanted Greece to stay. It's like with you mother-in-law visiting. You have to act, sob at the door that she must already leave and oh when will I see you again. Crocodile tears and all. Even if inside you're dancing.

News –

Between The Hedges

Markets – Between

The Hedges

Recap – Global

Macro Trading

The Closer

– alphaville

/ FT

Market

Commentary – A

View from My Screens

Asian

Morning Briefing – BNY

Mellon

Tyler’s US Summary – ZH

As

Reality Recedes, Rumor Rampage Returns

Debt

crisis: live – The

Telegraph

The Euro

Crisis Blog – WSJ

FX Options

Analytics – Saxo

Bank

European

10yr Yields and Spreads – MTS indices

|

| The outflows, the balances |

EURO CRISIS: GENERAL

EU Summit Dinner Menu: Indigestion – Credit

Writedowns

The scope for compromise that seems most

realistic is 1) allowing countries extra time to reach fiscal targets, 2)

expanded EIB and project bonds for infrastructure/public investment, 3) provide

easier access to cohesion funds and 4) EMU-wide guarantee for savings deposits.

The last point seems to be a bit of a stretch… The bottom line is that today’s

informal EU summit is not the real thing. It is out of the late June summit

that a new effort will likely emerge.

Euro Basis Swap Flashing Coordinated Liquidity

Intervention Red Light – ZH

With LTRO funding now faded and perception of

the sustainability of European banks becoming dismal, US banks are charging

ever higher rates for Eurozone banks to borrow.

EU Summit Dinner Menu: Indigestion – Marc

to Market

The EU informal summit will be held over a

dinner and despite the attention it is receiving, it still seems unreasonable

to expect anything concrete. Negotiating positions will be staked out, but most

of the issues will require greater negotiations. June or even July seems a more

likely time frame for yet another "comprehensive solution."

|

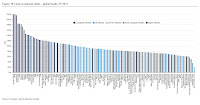

| European banks are leveraged |

Goldman Pops The "Deus GrEx

Machina" Balloon

– ZH

Goldman

Sachs: the ECB cannot deal with concerns

about bank solvency and/or deposit currency redenomination. That requires a

pan-Euro area guarantee of the Euro value of bank deposits by the fiscal

authorities.

new capital flow data from March, which

worsened considerably, via a missive from Nomura analysts on Wednesday

In Europe, Time for Plan B, Only There’s No Plan, and No Time – MarketBeat

/ WSJ

Something concrete finally came out of a eurocrat summit. The Germans said no… This crisis was ultimately going to resolve itself in one of two ways: the Continent was either going to form a United States of Europe, or the euro experiment was going to fail. It appears to be going in the latter direction.

Something concrete finally came out of a eurocrat summit. The Germans said no… This crisis was ultimately going to resolve itself in one of two ways: the Continent was either going to form a United States of Europe, or the euro experiment was going to fail. It appears to be going in the latter direction.

Sitting At The Edge Of The World – Mark Grant / ZH

If you listen carefully you can hear the

tremors in the Spanish voices, the inflections of need, the beginnings of

sentences not quite finished. Spain has arrived at the

wall; now all that is left is the public announcement.

European Parliament chief Martin Schulz has

launched a scathing attack on the German chancellor for promoting policies he

says drive up the borrowing costs of other euro-countries, while Germany has just hit a record zero-percent interest rate on its bonds.

|

| Follows the CB balance sheets |

SocGen’s Sebastien Galy Says Euro Should `Slide

Lower’ – BB (mp3)

EURO CRISIS: GREECE

on Monday a Eurogroup Working Group held a

teleconference in which officials "agreed to prepare for individual

contingency plans if and when Greece exits."

Euro-zone officials have stepped up planning to

contain the fallout of a possible Greek exit from the euro zone, even as

European leaders meeting here Wednesday said they want the country to remain in

the single currency area.

Pressure on Greece increased

dramatically on Wednesday night after Germany's central bank called for a suspension of financial support to Athens and eurozone finance

ministries agreed to draft contingency plans for a Greek exit from the euro.

I find your lack of faith disturbing – alphaville

/ FT

The ‘Greece’ section of the

Bundesbank’s latest report on the German economy must be read to be believed:

Eurosystem should not increase its risks from Greece

|

| S&P 500 selects the President |

OTHER

QE's Long Shadow Is Getting Shorter – ZH

Still more

room to go before the end of “QE bottom”

FT Alphaville has been focusing on signs that China may be suffering a

“capital outflow” problem. We also think global markets may be under

appreciating the problem.